The cell viability assays market size is estimated to be USD 1,607.1 million in 2022 and is expected to witness a CAGR of 9.98% during the forecast period 2023-2033. Rising incidence of infectious and chronic diseases and growing emphasis on cell-based treatments are some of the factors contributing to the market growth. Additionally, developing advanced technologies by key market players, increasing funding for stem cell research and surge in the usage of automated devices are other factors supporting the market growth. However, high price of instruments is expected to hinder the growth.

Increasing funding for stem cell research is expected to propel the market growth during the projected period. For instance, the Federal Minister for Health and Aged Care, the Hon. Greg Hunt, provided funding for the 2020 Stem Cell Mission in the amount of USD 18 million in June 2021. The objective is to enhance health outcomes through research that produces new, secure, and efficient stem cell therapeutics. Additionally, Curi Bio received investment in the amount of USD 10 million in January 2022 for a drug discovery platform that focuses on stem cells. Therefore, it is anticipated that the market will be driven during the study period by the growing emphasis on stem cell research.

Developing advanced technologies by key market players is predicted to spur the market growth during the forecast period. To evaluate cell health, death, apoptosis, and necrosis, for instance, Nanolive introduced the automated LIVE Cell Death Assay (LCDA) in September 2022. The LCDA is a simple test that provides 13 indicators for viability and death. Various pharmaceutical and biopharmaceutical companies, diagnostics labs, and academic and research institutions have adopted the cell viability assay frequently as a result of these technological advancements.

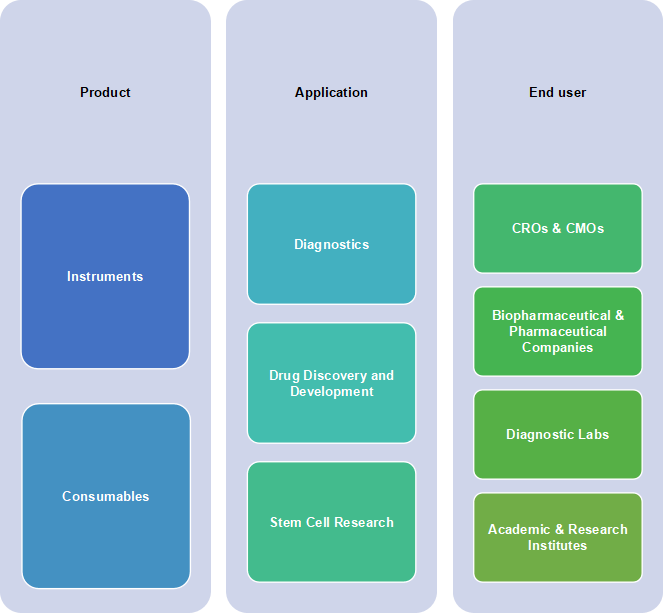

Segmentation

By Product

By Product

The market is categorized into instruments and consumables. In 2022, the consumables segment accounted for the highest revenue share due to the use of consumables in many pharmaceutical and biopharmaceutical, diagnostic, and stem cell research applications. Additionally, a number of market participants are providing a large variety of non-toxic, ready-to-use reagents for cell viability assays that deliver immediate, high-quality findings. For instance, the alamarBlue cell viability reagent provided by Thermo Fisher Scientific, Inc. is a non-toxic ready-to-use reagent solution that serves as a cell health indicator by quantitatively measuring viability by consuming the reducing power of live cells. Luminometric assays maintained a leading share in 2022 and are expected to experience the fastest rise in the predicted period due to their easy methods, minimal equipment requirements, robustness, and high sensitivity. Fluorometric assays held the second-largest proportion in 2022 due to the fact that they are more sensitive than colorimetric and dye exclusion assay. All of these characteristics make it simple to scale and adapt from bench research to high throughput applications. Such characteristics of the cell viability assay are promoting the expansion of the consumables market.

By Application

By Application

The market is categorized into diagnostics, drug discovery and development, and stem cell research. In the global market, the stem cell research segment accounted for the largest revenue share in 2022 owing to recent increases in financing for stem cell research. For instance, in May 2022, Canada’s Stem Cell Network announced USD 19.5 million in financing for 32 clinical studies and projects involving regenerative medicine and stem cell research. The development of cutting-edge tools to support the research is being pushed forward by major participants in the market. For instance, Beckman Coulter Life Sciences launched their innovative AQUIOS STEM System in May 2022 for stem cell analysis. By eliminating manual, error-prone stages and significantly reducing turnaround time, the innovation aids in the analysis and enumeration of live cells. In 2022, the segment for drug discovery and development had the second-largest share. Cell viability assays are essential at various stages of drug discovery and development due to their diversity, adaptability, and flexibility. Cell viability assays are mostly used for screen the reaction of the cells to a chemical compound or a medicine during the drug discovery and development process.

By End User

By End User

The market is segmented into CROs & CMOs, biopharmaceutical & pharmaceutical companies, diagnostic labs, and academic & research institutes. In 2022, the biopharmaceutical & pharmaceutical companies segment accounted for the largest revenue share owing to widespread usage of viability assay in pharmaceuticals to assess the impact of new drugs on cells. To track the effectiveness of developed therapies, which frequently target cancer tumours, researchers employ a wide variety of assays. Additionally, a cell viability assay can be used to assess the substances’ or agents’ levels of toxicity. The segment is driven by the biopharmaceutical and pharmaceutical industries’ numerous uses of cell viability assay. CROs and CMOs are anticipated to expand at the fastest pace over the projected period. These partnerships can save costs, speed up time to market, and enhance process effectiveness. For the development of BAMLET for pharmaceutical use, Hamlet Pharma and CRO Galenica AB signed a partnership agreement in November 2021. Cell viability assays can be used to determine the biological activity of BAMLET, a potent treatment for colon cancer, and to create an effective medication formulation. These collaborations are anticipated to expand the use of cell viability assays in a variety of applications, such as drug research and development, which will support industry growth over the coming years.

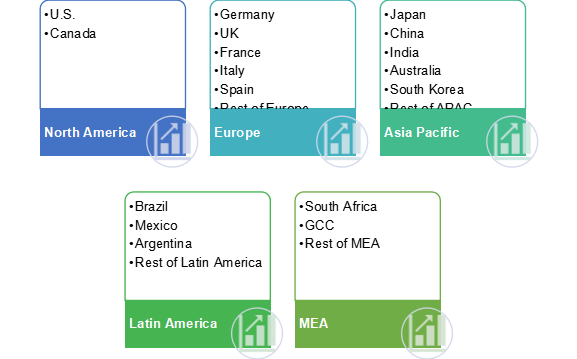

Regional Markets

In 2022, North America region accounted for the highest revenue in the cell viability assays market and is expected to maintain its dominance during the forecast period. This is attributed to the significant increase in investment initiatives by the government, the rise in the prevalence of chronic diseases including cancer, and the presence of an upper infrastructure for clinical and laboratory research in North America are all factors that contribute to this significant share. For instance, according to Globocanreport, there were almost 612,390 deaths and 2,281,658 new cancer cases in the U.S. in 2020. As a result, the market’s growth prospects are expanding due to the rising incidence of chronic and infectious diseases and the growing emphasis on cell-based treatments. Asia Pacific is predicted to experience the fastest increase during the projection period due to the increasing demand for innovative therapies in the region. Other factors promoting regional growth include escalating government expenditure in R&D and accelerating infrastructure growth.

Competitor Insights

Some of the key players operating in the cell viability assays market are Biotium, Abcam plc, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Merck KGaA, BD, Promega Corporation, Creative Bioarray, Thermo Fisher Scientific, Inc., PerkinElmer Inc., and Charles River Laboratories.

To achieve a competitive edge, these companies are implementing a variety of growth strategies. Strategic partnerships, alliances, and agreements with different businesses and research institutions are seen to be the main strategies used by companies in this sector.

- For instance, in April 2020, BioTek Instruments announced an advanced starting kit for cell count and viability. By automating the tedious and error-prone procedure of cell counting, the kit can assist researchers in obtaining high-quality cell data fast.

This comprehensive research report focuses on the global and regional market size and forecasts of diverse segments including product, application, and end user from 2023 to 2033.

Report Scope:

| Key Parameters | Details |

|---|---|

| Market size in 2022 |

|

| CAGR |

|

| Base Year |

|

| Forecast Period |

|

| Study Coverage |

|

| Qualitative Analysis |

|

| Segment Market Scope |

|

| Regional Market Scope |

|

| Company Profiles |

|

| 15% Free Customization Available |

|

Segmentation: Cell Viability Assays Market Report 2022 – 2033

Product (Revenue, USD Million), 2022 – 2033

- Instruments

- Microscopy

- Spectrophotometer

- Flow Cytometry

- Cell Imaging And Analysis System

- Others

- Consumables

- Microplates

- Reagents & Assay Kits

- Colorimetric Assays

- Dye Exclusion Assays

- Luminometric Assays

- Fluorometric Assays

Application (Revenue, USD Million), 2022 – 2033

- Diagnostics

- Drug Discovery and Development

- Stem Cell Research

End user (Revenue, USD Million), 2022 – 2033

- CROs & CMOs

- Biopharmaceutical & Pharmaceutical Companies

- Diagnostic Labs

- Academic & Research Institutes

By Region (Revenue, USD Million), 2022 – 2033

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

Table of Contents: Cell Viability Assays Market 2022-2033

- Research Methodology

- Study Objectives

- Study Scope

- Research Framework

- Research Models

- Bottom-up Approach

- Top-down Approach

- Data Triangulation

- Data Analysis

- Data Validation

- Market Size Estimation

- Market Forecast Model

- Research Models

- Introduction: Cell Viability Assays

- Executive Summary

- Market Dynamics

- Market Drivers

- Driver 1

- Driver 2

- Driver 3

- Driver 4

- Market Restraint

- Restraint 1

- Restraint 2

- Restraint 3

- Market Opportunities

- Opportunity 1

- Opportunity 2

- Opportunity 3

- Market Trends

- Trend 1

- Trend 2

- Trend 3

- Market Challenges

- Challenge 1

- Challenge 2

- Challenge 3

- Market Drivers

- Market Environment Analysis

- Porter’s 5 Forces Analysis

- PESTEL Analysis

- SWOT Analysis

- COVID-19 Impact Analysis: Cell Viability Assays Market

- Market Analysis by Product

- Instruments

- InstrumentsMarket Forecast, 2022-2033 (USD Million)

- Microscopy

- MicroscopyMarket Forecast, 2022-2033 (USD Million)

- Spectrophotometer

- SpectrophotometerMarket Forecast, 2022-2033 (USD Million)

- Flow Cytometry

- Flow Cytometry MarketForecast, 2022-2033 (USD Million)

- Cell Imaging And Analysis System

- Cell Imaging And Analysis SystemMarket Forecast, 2022-2033 (USD Million)

- Others

- OthersMarket Forecast, 2022-2033 (USD Million)

- Consumables

- Consumables Market Forecast, 2022-2033(USD Million)

- Microplates

- MicroplatesMarket Forecast, 2022-2033 (USD Million)

- Reagents & Assay Kits

- Reagents & Assay KitsMarket Forecast, 2022-2033 (USD Million)

- Colorimetric Assays

- Colorimetric AssaysMarket Forecast, 2022-2033 (USD Million)

- Dye Exclusion Assays

- Colorimetric Assays

- Reagents & Assay KitsMarket Forecast, 2022-2033 (USD Million)

- Microplates

- Consumables Market Forecast, 2022-2033(USD Million)

- Microscopy

- InstrumentsMarket Forecast, 2022-2033 (USD Million)

- Instruments

7.2.1.2.1.2.1. Dye Exclusion Assays

- Luminometric Assays

- Luminometric AssaysMarket Forecast, 2022-2033 (USD Million)

- Fluorometric Assays

- Fluorometric Assays Market Forecast, 2022-2033(USD Million)

- Market Analysis by Application

- Diagnostics

- Diagnostics Market Forecast, 2022-2033(USD Million)

- Drug Discovery and Development

- Drug Discovery and Development Market Forecast, 2022-2033(USD Million)

- Stem Cell Research

- Stem Cell Research Market Forecast, 2022-2033(USD Million)

- Diagnostics

- Market Analysis by End User

- CROs & CMOs

- CROs & CMOs Market Forecast, 2022-2033(USD Million)

- Biopharmaceutical & Pharmaceutical Companies

- Biopharmaceutical & Pharmaceutical Companies Market Forecast, 2022-2033(USD Million)

- Diagnostic Labs

- Diagnostic Labs Market Forecast, 2022-2033(USD Million)

- Academic & Research Institutes

- Academic & Research Institutes Market Forecast, 2022-2033(USD Million)

- CROs & CMOs

- Regional Market Analysis

- Regional Market Trends Analysis

- North America Cell Viability Assays Market

- North America Cell Viability Assays Market

- North America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- S. Cell Viability Assays Market

- S. Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Cell Viability Assays Market

- Canada Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Market Size and Forecast, 2022-2033(USD Million)

- S. Market Size and Forecast, 2022-2033(USD Million)

- North America Market Size and Forecast, 2022-2033(USD Million)

- North America Cell Viability Assays Market

- Europe Cell Viability Assays Market

- Europe Cell Viability Assays Market

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Germany Cell Viability Assays Market

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- UK Cell Viability Assays Market

- UK Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- France Cell Viability Assays Market

- France Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Spain Cell Viability Assays Market

- Spain Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Italy Cell Viability Assays Market

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Cell Viability Assays Market

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Spain Market Size and Forecast, 2022-2033(USD Million)

- France Market Size and Forecast, 2022-2033(USD Million)

- UK Market Size and Forecast, 2022-2033(USD Million)

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Europe Cell Viability Assays Market

- Asia Pacific Cell Viability Assays Market

- Asia Pacific Cell Viability Assays Market

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Japan Cell Viability Assays Market

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- China Cell Viability Assays Market

- China Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- India Cell Viability Assays Market

- India Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Korea Cell Viability Assays Market

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Australia Cell Viability Assays Market

- Australia Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Cell Viability Assays Market

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Australia Market Size and Forecast, 2022-2033(USD Million)

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- India Market Size and Forecast, 2022-2033(USD Million)

- China Market Size and Forecast, 2022-2033(USD Million)

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Cell Viability Assays Market

- Latin America Cell Viability Assays Market

- Latin America Cell Viability Assays Market

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Brazil Cell Viability Assays Market

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Mexico Cell Viability Assays Market

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Argentina Cell Viability Assays Market

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Cell Viability Assays Market

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Latin America Cell Viability Assays Market

- MEA Cell Viability Assays Market

- MEA Cell Viability Assays Market

- MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- GCC Cell Viability Assays Market

- GCC Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Africa Cell Viability Assays Market

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Cell Viability Assays Market

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- GCC Market Size and Forecast, 2022-2033(USD Million)

- MEA Market Size and Forecast, 2022-2033(USD Million)

- MEA Cell Viability Assays Market

- Competitor Analysis

- Market Share Analysis, 2022

- Major Recent Developments, 2019-2022

- Company Profiles

- Biotium

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Abcam plc

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Agilent Technologies, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Bio-Rad Laboratories, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Merck KGaA

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- BD

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Promega Corporation

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Creative Bioarray

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Thermo Fisher Scientific, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- PerkinElmer Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Charles River Laboratories

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 12

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 13

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 14

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 15

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Biotium

- Conclusion

- Recommendations