The breast cancer liquid biopsy market size is estimated to be USD 289.5 million in 2022 and is expected to witness a CAGR of 23.85 % during the forecast period 2023-2033. Rising incidence of breast cancer in the general population, greater knowledge of early detection and treatment, and rising consumer demand for minimally invasive procedures are some of the factors projected to drive the market growth in near future. Furthermore, increasing initiatives by key market players and technological developments are other factor supporting the market growth. However, lack of precision and specificity of the tests, together with their high costs are expected to restrain the market growth.

Increasing initiatives by key market players is expected to propel the market growth during the forecast period. To increase the use of biopsies worldwide, a number of companies are launching initiatives, which is fueling growth. The commercialization of such tests in the coming years is anticipated to simplify the detection of the ailment. According to John Hopkins Medicine in June 2022, liquid biopsy can be used to detect advanced breast cancer biomarkers in 5 hours.

Rising incidence of breast cancer in the general population is predicted to fuel the market growth during the projected period. For instance, the WHO estimates that 2.3 million women worldwide got a breast cancer diagnosis in 2020, leading to 685,000 deaths among them. One of the most frequent uses of liquid biopsy is for the diagnosis of breast cancer, which uses mutational analysis to choose the most effective targeted treatment. For instance, screening for the PIK3CA mutation, which is present in around 40% of all HR-positive breast cancers, can help determine the next step in treatment for patients with metastatic illness.

Segmentation

By Circulating Biomarkers

By Circulating Biomarkers

The market is categorized into circulating cell-free DNA, extracellular vesicles, circulating tumor cells, and other circulating biomarkers. In 2022, the circulating cell-free DNA segment accounted for the highest revenue share due to non-invasive methods provided by cfDNA to diagnosis recurrence or progression, simplify prognosis, find emerging genomic abnormalities. For use in scientific research, many companies offer cfDNA-based products. Multiple tests that use cfDNA as a way of cancer detection are currently being developed. For instance, Yemaachi Biotech and Lucence declared the start of a study in Africa for the characterization of genomic abnormalities using Liquid HALLMARK test in African Women in October 2021. This project is aimed to increase access to liquid biopsy and make it more convenient. The segment for circulating tumor cells (CTCs) is anticipated to expand at the fastest rate during the projected period. The potential of CTCs to provide improved sensitivity as biomarkers for the early diagnosis of cancer, with larger CTCs counts being associated to a very high risk of getting cancer, is related with the segment’s rise.

By Application

By Application

The market is categorized diagnosis, early detection/screening, monitoring, and treatment selection. In the global market, the treatment selection segment accounted for the largest revenue share in 2022 owing to requirement for early treatment. The relevance of early identification, characterization, and management of breast cancer in its early stages has increased as a result of the development of liquid biopsies, making this clinical environment the most suitable to improve the probability of effective treatment selection and improved prognosis. For instance, in August 2020, the FDA approved FoundationOne Liquid CDx’s ctDNA-based CGP assay, which is meant to be used in concert with other diagnostic tests to assist physicians in determining that patients will benefit from getting targeted medications. The diagnosis segment is anticipated to have profitable expansion over the projection period. The growth is due to the liquid biopsy’s rising dominance in the field of cancer diagnostics. Clinical oncology has undergone a significant transformation due to liquid biopsy, which makes cancer monitoring and continuous cancer sampling easier and improves early cancer identification. The development of liquid biopsy technology and growing public knowledge of non-invasive, risk-free diagnostic methods are both credited with the expansion.

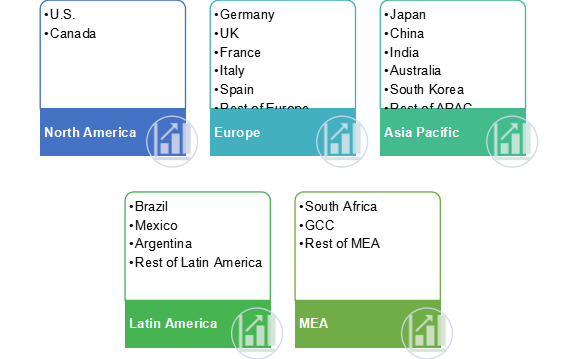

Regional Markets

In 2022, North America region accounted for the highest revenue in the breast cancer liquid biopsy market and is expected to maintain its dominance during the forecast period. This is attributed to rapid technological development, use of liquid biopsies in treatment decision-making, and expanding government efforts. The U.S. dominates the North American market due to higher investments and the existence of numerous biotechnology companies producing the tests. It is anticipated that higher product usage will result from the region’s growing access to liquid biopsy tests. For instance, Johns Hopkins launched the GeneXpert system-compatible LBx-BCM test for research use in June 2022. This test was created in collaboration with Cepheid. Asia Pacific is anticipated to experience profitable growth over the forecast period. The cancer rate is very high in the Asia-Pacific region due to its enormous population. In 2020, Asia was home to an estimated 58.3% of cancer fatalities and approximately half of all new cases, according to Global Cancer Statistics 2020.

Competitor Insights

Some of the key players operating in the breast cancer liquid biopsy market are Sysmex Corporation, Myriad Genetics, Inc., NeoGenomics Laboratories, The Menarini Group, Fluxion Biosciences, Inc., QIAGEN, Biocept, Inc., Epic Sciences, Inc., F. Hoffmann-La Roche Ltd., and Thermo Fisher Scientific Inc.

To achieve a competitive edge, these companies are implementing a variety of growth strategies. Strategic partnerships, alliances, and agreements with different businesses and research institutions are seen to be the main strategies used by companies in this sector.

For instance, in September 2022, a group of scientists led by USC discovered evidence that liquid biopsy can be used to detect breast cancer in its early stages. The team consisted of USC, Epic Sciences, Billings Clinic, USC Norris Comprehensive Cancer Center, and Duke University.

This comprehensive research report focuses on the global and regional market size and forecasts of diverse segments including circulating biomarkers and application from 2022 to 2033.

Report Scope:

| Key Parameters | Details |

|---|---|

| Market size in 2022 |

|

| CAGR |

|

| Base Year |

|

| Forecast Period |

|

| Study Coverage |

|

| Qualitative Analysis |

|

| Segment Market Scope |

|

| Regional Market Scope |

|

| Company Profiles |

|

| 15% Free Customization Available |

|

Segmentation: Breast Cancer Liquid Biopsy Market Report 2022 – 2033

Circulating Biomarkers (Revenue, USD Million), 2022 – 2033

- Circulating Cell-free DNA

- Extracellular Vesicles

- Circulating Tumor Cells

- Other Circulating Biomarkers

Application (Revenue, USD Million), 2022 – 2033

- Diagnosis

- Early Detection/Screening

- Monitoring

- Treatment Selection

By Region (Revenue, USD Million), 2022 – 2033

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

Table of Contents: Breast Cancer Liquid Biopsy Market 2022-2033

- Research Methodology

- Study Objectives

- Study Scope

- Research Framework

- Research Models

- Bottom-up Approach

- Top-down Approach

- Data Triangulation

- Data Analysis

- Data Validation

- Market Size Estimation

- Market Forecast Model

- Research Models

- Introduction: Breast Cancer Liquid Biopsy

- Executive Summary

- Market Dynamics

- Market Drivers

- Driver 1

- Driver 2

- Driver 3

- Driver 4

- Driver 5

- Market Restraint

- Restraint 1

- Restraint 2

- Restraint 3

- Restraint 4

- Market Opportunities

- Opportunity 1

- Opportunity 2

- Opportunity 3

- Opportunity 4

- Market Trends

- Trend 1

- Trend 2

- Trend 3

- Trend 4

- Market Challenges

- Challenge 1

- Challenge 2

- Challenge 3

- Challenge 4

- Market Drivers

- Market Environment Analysis

- Porter’s 5 Forces Analysis

- PESTEL Analysis

- SWOT Analysis

- COVID-19 Impact Analysis: Breast Cancer Liquid Biopsy Market

- Market Analysis by Circulating Biomarkers

- Circulating Cell-free DNA

- Circulating Cell-free DNA Market Forecast, 2022-2033(USD Million)

- Extracellular Vesicles

- Extracellular Vesicles Market Forecast, 2022-2033(USD Million)

- Circulating Tumor Cells

- Circulating Tumor Cells Market Forecast, 2022-2033(USD Million)

- Other Circulating Biomarkers

- Other Circulating Biomarkers Market Forecast, 2022-2033(USD Million)

- Circulating Cell-free DNA

- Market Analysis byApplication

- Diagnosis

- Diagnosis Market Forecast, 2022-2033(USD Million)

- Early Detection/Screening

- Early Detection/Screening Market Forecast, 2022-2033(USD Million)

- Monitoring

- Monitoring Market Forecast, 2022-2033(USD Million)

- Treatment Selection

- Treatment Selection Market Forecast, 2022-2033(USD Million)

- Diagnosis

- Regional Market Analysis

- Regional Market Trends

- North America Breast Cancer Liquid Biopsy Market

- North America Breast Cancer Liquid Biopsy Market

- North America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- S. Breast Cancer Liquid Biopsy Market

- S. Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Canada Breast Cancer Liquid Biopsy Market

- Canada Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Canada Market Size and Forecast, 2022-2033(USD Million)

- S. Market Size and Forecast, 2022-2033(USD Million)

- North America Market Size and Forecast, 2022-2033(USD Million)

- North America Breast Cancer Liquid Biopsy Market

- Europe Breast Cancer Liquid Biopsy Market

- Europe Breast Cancer Liquid Biopsy Market

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Germany Breast Cancer Liquid Biopsy Market

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- UK Breast Cancer Liquid Biopsy Market

- UK Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- France Breast Cancer Liquid Biopsy Market

- France Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Spain Breast Cancer Liquid Biopsy Market

- Spain Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Italy Breast Cancer Liquid Biopsy Market

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Europe Breast Cancer Liquid Biopsy Market

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Spain Market Size and Forecast, 2022-2033(USD Million)

- France Market Size and Forecast, 2022-2033(USD Million)

- UK Market Size and Forecast, 2022-2033(USD Million)

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Europe Breast Cancer Liquid Biopsy Market

- Asia Pacific Breast Cancer Liquid Biopsy Market

- Asia Pacific Breast Cancer Liquid Biopsy Market

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Japan Breast Cancer Liquid Biopsy Market

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- China Breast Cancer Liquid Biopsy Market

- China Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- India Breast Cancer Liquid Biopsy Market

- India Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- South Korea Breast Cancer Liquid Biopsy Market

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Market Size and Forecast by Device, 2022-2033(USD Million)

- Australia Breast Cancer Liquid Biopsy Market

- Australia Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Asia Pacific Breast Cancer Liquid Biopsy Market

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Australia Market Size and Forecast, 2022-2033(USD Million)

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- India Market Size and Forecast, 2022-2033(USD Million)

- China Market Size and Forecast, 2022-2033(USD Million)

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Breast Cancer Liquid Biopsy Market

- Latin America Breast Cancer Liquid Biopsy Market

- Latin America Breast Cancer Liquid Biopsy Market

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Brazil Breast Cancer Liquid Biopsy Market

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Mexico Breast Cancer Liquid Biopsy Market

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Argentina Breast Cancer Liquid Biopsy Market

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Latin America Breast Cancer Liquid Biopsy Market

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Latin America Breast Cancer Liquid Biopsy Market

- MEA Breast Cancer Liquid Biopsy Market

- MEA Breast Cancer Liquid Biopsy Market

- MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- GCC Breast Cancer Liquid Biopsy Market

- GCC Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- South Africa Breast Cancer Liquid Biopsy Market

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of MEA Breast Cancer Liquid Biopsy Market

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Circulating Biomarkers,2022-2033 (USD Million)

- Market Size and Forecast by Application, 2022-2033(USD Million)

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- GCC Market Size and Forecast, 2022-2033(USD Million)

- MEA Market Size and Forecast, 2022-2033(USD Million)

- MEA Breast Cancer Liquid Biopsy Market

- Competitor Analysis

- Market Share Analysis, 2022

- Major Recent Developments, 2019-2022

- Company Profiles

- Sysmex Corporation

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Myriad Genetics, Inc.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- NeoGenomics Laboratories

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- The Menarini Group

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Fluxion Biosciences, Inc.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- QIAGEN

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Biocept, Inc.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Epic Sciences, Inc.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Hoffmann-La Roche Ltd.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Thermo Fisher Scientific Inc.

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Company 11

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Company 12

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Company 13

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Company 14

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Company 15

- Company Snapshot

- Company Overview

- Financials

- Product Benchmarking

- Recent Developments

- Others Prominent Players

- Sysmex Corporation

- Conclusion & Recommendations