The life science tools market size is estimated to be USD 129,247.1 million in 2022 and is expected to witness a CAGR of 7.11% during the forecast period 2023-2033. Rising need for diagnostic tests for numerous infectious diseases and increasing prevalence of diseases including cancer, renal & thyroid disorders, and diabetes are factors contributing to the market growth. Furthermore, technological developments and rapid growth of monoclonal antibodies in the field of cancer therapy is predicted to support the market growth. However, expensive technologies that require substantial R&D and infrastructure investments is expected to hinder the growth.

Technological developments are expected to propel the market growth during the projected period. Mass spectrometry, chromatography techniques, sequencing technologies, and other items have all seen a rise in their use in diagnostic labs, hospitals, and other settings due to technological developments. For instance, liquid chromatography coupled to mass spectrometry (LC-MS) is a potent tool for characterising antibody-drug conjugates, according to a research study titled “Rapid Analysis of Reduced Antibody Drug Conjugate by Online LC-MS/MS with Fourier Transform Ion Cyclotron Resonance Mass Spectrometry” published in October 2020.

Rapid growth of monoclonal antibodies in the field of cancer therapy is projected to fuel the market growth during the forecast period. For instance, 27 monoclonal antibodies have received approval to treat various cancers, according to a report by mAbxience and released in January 2021. Additionally, the FDA’s approval of monoclonal antibodies for use in cancer therapy and diagnostics is expanding the uses of biologics. For instance, the FDA authorised Tebentafusp-tebn, a monoclonal antibody that helps treat metastatic uveal melanoma, in January 2022.

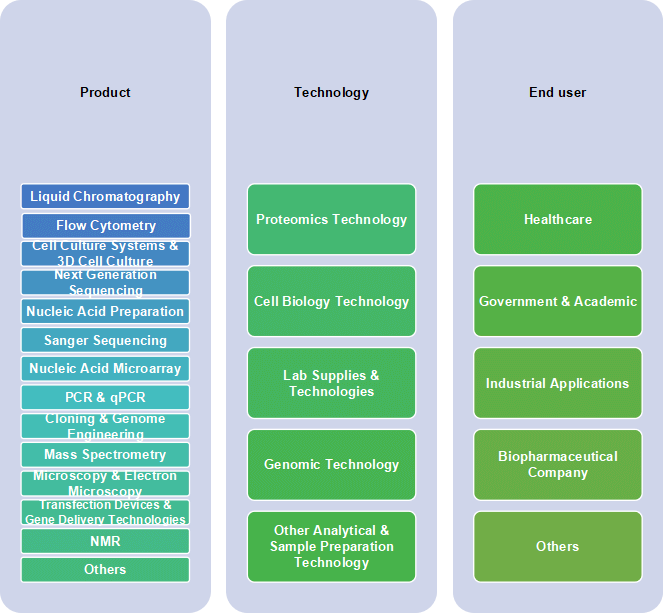

Segmentation

By Product

By Product

The market is categorized into Liquid chromatography, flow cytometry, cell culture systems & 3D cell culture, next generation sequencing, nucleic acid preparation, sanger sequencing, nucleic acid microarray, PCR & QPCR, cloning & genome engineering, mass spectrometry, microscopy & electron microscopy, transfection devices & gene delivery technologies, NMR, others. In 2022, the cell culture systems & 3D cell culture segment accounted for the highest revenue share due to the fact that cell biology-related research projects have made significant advancements and helped generate revenue. A thorough knowledge of cell biology has emerged as an essential tool for laboratory workflows, creating new opportunities for market growth. Additionally, professionals in the field of life sciences are eager to adopt new and advanced instruments, which is predicted to further support the sector. For instance, a number of companies, including Cytiva, BioTek Tools, Horizon Discovery, and Seahorse Bioscience, are planning to introduce instruments for cell analysis, cell biology, and imaging.

By Technology

By Technology

The market is categorized into proteomics technology, cell biology technology, lab supplies & technologies, genomic technology, and other analytical & sample preparation technology. In the global market, the cell biology technology segment accounted for the largest revenue share in 2022 owing to increasing NIH funding for cell biology and the application of cell biology technology in drug discovery. Additionally, major market participants have conducted research collaborations projects to convert newborn stem cells from umbilical cord tissue and blood into induced pluripotent stem cells (iPSCs). For instance, EdiGene and Haihe Laboratory formed a strategic partnership in January 2022 to develop platform technologies and stem cell regenerative treatments. The proteomics technology segment is anticipated to increase significantly over the course of the projection period. Proteomics enables an extensive study of many protein types and offers a complete understanding of the structural and functional information of cells.

By End User

By End User

The market is segmented into healthcare, government & academic, industrial applications, biopharmaceutical company, and others. In 2022, the healthcare segment accounted for the largest revenue share owing to rise in the usage of proteomic and genomic processes in hospitals for the diagnosis and treatment of various diseases. In addition, the market is anticipated to be driven by hospitals’ increasing use of tissue diagnostic and NGS services. One such hospital that offers sequencing services to those with a rare or unidentified genetic disorder is Stanford Medicine. One of the first hospital systems in the United States to offer public services for genomic sequencing, analysis, and interpretation is Partners HealthCare. It is anticipated that genomic sequencing in a hospital or clinical setting will enhance patient care while bringing down medical expenses. As a result, the healthcare sector is anticipated to grow at the fastest rate moving forward. The market is anticipated to be driven by the increasing interest of biopharmaceutical companies in genomics, which also generates substantial revenue.

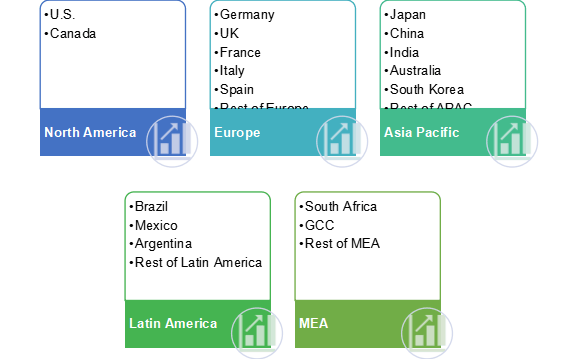

Regional Markets

In 2022, North America region accounted for the highest revenue in the life science tools market and is expected to maintain its dominance during the forecast period. This is attributed to the rapid penetration of genomics, proteomics, oncology, and diagnostic screening in the region. The expansion of the market in the region is attributable to the increase in the use of genomic medicine, biopharmaceuticals, diagnostic techniques, and novel technologies in the United States and Canada for the diagnosis and treatment of clinical disorders. The region also benefits from the existence of a large number of market participants who are consistently working to develop cutting-edge equipment for life science research. Additionally, the market is anticipated to increase over the course of the forecast period due to the availability of a well-regulated environment for the approval and use of genomic and tissue diagnostic tests. The Asia-Pacific area will exhibit the fastest growth during the forecast period. Growth will be fueled by investments and efforts made by international businesses in this region to take advantage of unexplored opportunities and strengthen their presence. For instance, in January 2022, FUJIFILM Corporation announced the purchase of the ATARA Biotherapeutics T-Cell Operations and Manufacturing (ATOM) facility for USD 100 million in order to manufacture commercial and clinical treatments, such as CAR-T and T-cell immunotherapies.

Competitor Insights

Some of the key players operating in the life science tools market are Illumina, Inc., QIAGEN N.V., Bruker Corporation, Hitachi Ltd., Danaher Corporation, Oxford Instruments plc, Becton, Dickinson and Company, Merck KGaA, Bio-Rad Laboratories, Inc., Shimadzu Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Inc, Agilent Technologies, Inc., and Zeiss International.

To achieve a competitive edge, these companies are implementing a variety of growth strategies. Strategic partnerships, alliances, and agreements with different businesses and research institutions are seen to be the main strategies used by companies in this sector.

- For instance, Agilent Technologies, Inc. and Biosciences, Inc. collaborated in February 2022 to integrate the AVITI System with SureSelect target enrichment panels for improved customer access to genomic tools. It was anticipated that the project would give the business new opportunities for expansion.

This comprehensive research report focuses on the global and regional market size and forecasts of diverse segments including product, technology, and end user from 2023 to 2033.

Report Scope:

| Key Parameters | Details |

|---|---|

| Market size in 2022 |

|

| CAGR |

|

| Base Year |

|

| Forecast Period |

|

| Study Coverage |

|

| Qualitative Analysis |

|

| Segment Market Scope |

|

| Regional Market Scope |

|

| Company Profiles |

|

| 15% Free Customization Available |

|

Segmentation: Life Science Tools Market Report 2022 – 2033

Product (Revenue, USD Million), 2022 – 2033

- Liquid Chromatography

- Flow Cytometry

- Cell Culture Systems & 3D Cell Culture

- Next Generation Sequencing

- Nucleic Acid Preparation

- Sanger Sequencing

- Nucleic Acid Microarray

- PCR & qPCR

- Cloning & Genome Engineering

- Mass Spectrometry

- Microscopy & Electron Microscopy

- Transfection Devices & Gene Delivery Technologies

- NMR

- Others

Technology (Revenue, USD Million), 2022 – 2033

- Proteomics Technology

- Cell Biology Technology

- Lab Supplies & Technologies

- Genomic Technology

- Other Analytical & Sample Preparation Technology

End user (Revenue, USD Million), 2022 – 2033

- Healthcare

- Government & Academic

- Industrial Applications

- Biopharmaceutical Company

- Others

By Region (Revenue, USD Million), 2022 – 2033

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

Table of Contents: Life Science Tools Market 2022-2033

- Research Methodology

- Study Objectives

- Study Scope

- Research Framework

- Research Models

- Bottom-up Approach

- Top-down Approach

- Data Triangulation

- Data Analysis

- Data Validation

- Market Size Estimation

- Market Forecast Model

- Research Models

- Introduction: Life Science Tools

- Executive Summary

- Market Dynamics

- Market Drivers

- Driver 1

- Driver 2

- Driver 3

- Driver 4

- Market Restraint

- Restraint 1

- Restraint 2

- Restraint 3

- Market Opportunities

- Opportunity 1

- Opportunity 2

- Opportunity 3

- Market Trends

- Trend 1

- Trend 2

- Trend 3

- Market Challenges

- Challenge 1

- Challenge 2

- Challenge 3

- Market Drivers

- Market Environment Analysis

- Porter’s 5 Forces Analysis

- PESTEL Analysis

- SWOT Analysis

- COVID-19 Impact Analysis: Life Science Tools Market

- Market Analysis by Product

- Liquid Chromatography

- Liquid Chromatography Market Forecast, 2022-2033(USD Million)

- Flow Cytometry

- Flow Cytometry Market Forecast, 2022-2033(USD Million)

- Cell Culture Systems & 3D Cell Culture

- Cell Culture Systems & 3D Cell Culture Market Forecast, 2022-2033(USD Million)

- Next Generation Sequencing

- Next Generation Sequencing Market Forecast, 2022-2033(USD Million)

- Nucleic Acid Preparation

- Nucleic Acid Preparation Market Forecast, 2022-2033(USD Million)

- Sanger Sequencing

- Sanger Sequencing Market Forecast, 2022-2033(USD Million)

- Nucleic Acid Microarray

- Nucleic Acid Microarray Market Forecast, 2022-2033(USD Million)

- PCR & qPCR

- PCR & qPCR Market Forecast, 2022-2033(USD Million)

- Cloning & Genome Engineering

- Cloning & Genome Engineering Market Forecast, 2022-2033(USD Million)

- Mass Spectrometry

- Mass Spectrometry Market Forecast, 2022-2033(USD Million)

- Microscopy & Electron Microscopy

- Microscopy & Electron Microscopy Market Forecast, 2022-2033(USD Million)

- Transfection Devices & Gene Delivery Technologies

- Transfection Devices & Gene Delivery Technologies Market Forecast, 2022-2033(USD Million)

- NMR

- NMR Market Forecast, 2022-2033(USD Million)

- Others

- Others Market Forecast, 2022-2033(USD Million)

- Liquid Chromatography

- Market Analysis by Technology

- Proteomics Technology

- Proteomics Technology Market Forecast, 2022-2033(USD Million)

- Cell Biology Technology

- Cell Biology Technology Market Forecast, 2022-2033(USD Million)

- Lab Supplies & Technologies

- Lab Supplies & Technologies Market Forecast, 2022-2033(USD Million)

- Genomic Technology

- Genomic Technology Market Forecast, 2022-2033(USD Million)

- Other Analytical & Sample Preparation Technology

- Other Analytical & Sample Preparation Technology Market Forecast, 2022-2033(USD Million)

- Proteomics Technology

- Market Analysis by End User

- Healthcare

- Healthcare Market Forecast, 2022-2033(USD Million)

- Government & Academic

- Government & Academic Market Forecast, 2022-2033(USD Million)

- Industrial Applications

- Industrial Applications Market Forecast, 2022-2033(USD Million)

- Biopharmaceutical Company

- Biopharmaceutical Company Market Forecast, 2022-2033(USD Million)

- Others

- Others Market Forecast, 2022-2033(USD Million)

- Healthcare

- Regional Market Analysis

- Regional Market Trends Analysis

- North America Life Science Tools Market

- North America Life Science Tools Market

- North America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- S. Life Science Tools Market

- S. Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Life Science Tools Market

- Canada Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Market Size and Forecast, 2022-2033(USD Million)

- S. Market Size and Forecast, 2022-2033(USD Million)

- North America Market Size and Forecast, 2022-2033(USD Million)

- North America Life Science Tools Market

- Europe Life Science Tools Market

- Europe Life Science Tools Market

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Germany Life Science Tools Market

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- UK Life Science Tools Market

- UK Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- France Life Science Tools Market

- France Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Spain Life Science Tools Market

- Spain Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Italy Life Science Tools Market

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Life Science Tools Market

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Spain Market Size and Forecast, 2022-2033(USD Million)

- France Market Size and Forecast, 2022-2033(USD Million)

- UK Market Size and Forecast, 2022-2033(USD Million)

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Europe Life Science Tools Market

- Asia Pacific Life Science Tools Market

- Asia Pacific Life Science Tools Market

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Japan Life Science Tools Market

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- China Life Science Tools Market

- China Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- India Life Science Tools Market

- India Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Korea Life Science Tools Market

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Australia Life Science Tools Market

- Australia Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Life Science Tools Market

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Australia Market Size and Forecast, 2022-2033(USD Million)

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- India Market Size and Forecast, 2022-2033(USD Million)

- China Market Size and Forecast, 2022-2033(USD Million)

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Life Science Tools Market

- Latin America Life Science Tools Market

- Latin America Life Science Tools Market

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Brazil Life Science Tools Market

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Mexico Life Science Tools Market

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Argentina Life Science Tools Market

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Life Science Tools Market

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Latin America Life Science Tools Market

- MEA Life Science Tools Market

- MEA Life Science Tools Market

- MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- GCC Life Science Tools Market

- GCC Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Africa Life Science Tools Market

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Life Science Tools Market

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Product, 2022-2033(USD Million)

- Market Size and Forecast by Technology, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- GCC Market Size and Forecast, 2022-2033(USD Million)

- MEA Market Size and Forecast, 2022-2033(USD Million)

- MEA Life Science Tools Market

- Competitor Analysis

- Market Share Analysis, 2022

- Major Recent Developments, 2019-2022

- Company Profiles

- Illumina, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- QIAGEN N.V.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Bruker Corporation

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Hitachi Ltd.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Danaher Corporation

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Oxford Instruments plc

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Becton, Dickinson and Company

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Merck KGaA

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Bio-Rad Laboratories, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Shimadzu Corporation

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Hoffmann-La Roche Ltd.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Thermo Fisher Scientific, Inc

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Agilent Technologies, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Zeiss International

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 15

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Illumina, Inc.

- Conclusion

- Recommendations