The large molecule drug substance CDMO market size is estimated to be USD 11,725.6 million in 2022 and is expected to witness a CAGR of 9.67% during the forecast period 2023-2033. Rising number of FDA-approved large molecule drugs, surge in prevalence of infectious diseases, higher demand for novel therapeutics, and increasing capital expenditures by pharma and biotech companies in cutting-edge technologies for forming partnerships with CDMOs are some of the factors contributing to the market growth. Furthermore, increasing burden chronic diseases and growing investments and forming strategic alliances are other factors supporting the market growth. However, strict governmental restrictions and decrease in the licencing of biologics in developed nations is expected to hinder the growth.

Increasing burden chronic diseases is expected to propel the market growth during the forecast period. According to the World Health Organization (WHO), the burden of non-communicable diseases (NCDs) will rise to 57% in 2020. The ageing population and increasing prevalence of chronic diseases are driving pharmaceutical companies to create effective pharmaceutical treatments that speed up the healing process. Additionally, it is anticipated that the acceptance of the one-stop-shop concept and the capacity of CDMOs to streamline the pharmaceutical supply chain would fuel the growth of the CDMO market during the course of the research period.

Growing investments and forming strategic alliances is predicted to fuel the market growth during the projected period. To develop novel chemicals and increase their global reach, many CDMOs are putting focus on capital investments. In October 2017, it was revealed that CordenPharma International had invested €3.7 million strategically in its Swiss plant for the production of small molecule APIs. An increase in the number of new players entering the market through partnerships is also anticipated to be a significant driver for the CDMO market expansion over the forecast period.

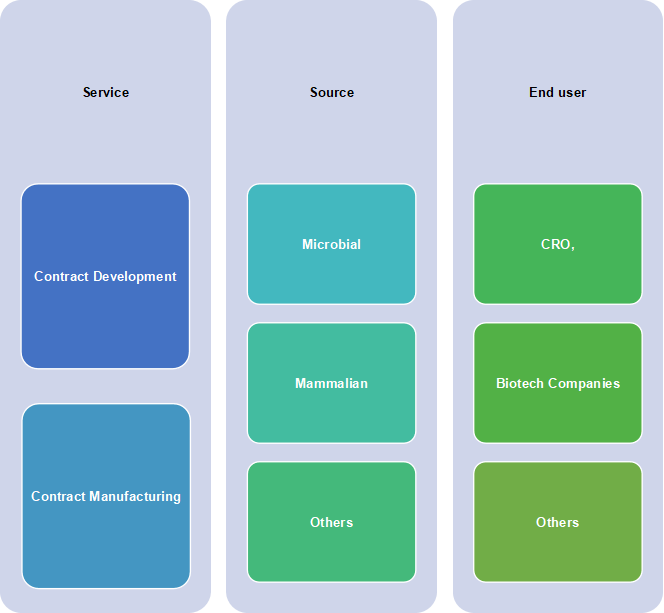

Segmentation

By Service

By Service

The market is categorized into contract development, contract manufacturing. In 2022, the contract manufacturing segment accounted for the highest revenue share due to the major advancements in production standards. Indian pharmaceutical businesses have substantial experience in contract manufacturing. The contract development segment is anticipated to grow at the fastest CAGR over the projection period. The segment is further subdivided into the development of cell lines and processes. The best CDMOs offer services for large molecules such as downstream processing and upstream processing in addition to a variety of analytical techniques for protein characterization and bioassays.

By Source

By Source

The market is categorized into microbial, mammalian, and others. In the global market, the mammalian segment accounted for the largest revenue share in 2022 owing to more complex biologics, including antibodies with two or three particularities and antibody-drug conjugates. mAbs and their synthetic equivalents have attracted a significant investment due to their efficiency in treating a range of diseases, including cancer. To treat diseases such as these, mAbs have historically been developed from mammalian therapeutics. The microbial source segment is expected to have the second-fastest CAGR during the projected period. Recombinant proteins are frequently produced for therapeutic uses in microbial systems. To present, 650 protein medicines have received global approval, 400 of which were from microbial recombinant technologies.

By End User

By End User

The market is segmented into CRO, biotech companies, and others. In 2022, the biotech companies segment accounted for the largest revenue share owing to rising R&D expenditures in the biopharmaceutical industry and increase in the number of diseases that biotech companies are actively researching. Additionally, mergers and acquisitions, regional expansion, product and service portfolio expansion, and competitive pricing are major methods used by biotech companies to remain competitive and increase market share. The others segment is anticipated to grow at the fastest CAGR over the projection period. It consists of pharmaceutical firms, governmental research groups, and academic institutions. Large molecules were traditionally the emphasis of biotechnology companies, while small molecules were the focus of pharmaceutical companies traditionally.

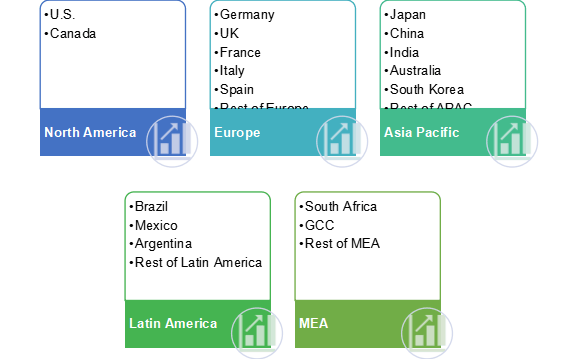

Regional Markets

In 2022, North America region accounted for the highest revenue in the large molecule drug substance CDMO market and is expected to maintain its dominance during the forecast period. This is attributed to the large patient base, lower total costs, a competent workforce, and changes in the regulatory environment. Additionally, companies including Wuxi Biologics and Boehringer Ingelheim are always looking for ways to expand their services in this region. For instance, in Hangzhou, Zhejiang province, China, Wuxi Biologics established biologics integrated innovation centre in November 2020. This centre will offer a variety of services, including manufacturing and process development. North America is anticipated to grow over the coming years due to significant R&D expenditures made by the U.S. For instance, the Pharmaceutical Research and Manufacturers of America reported in 2022 that American pharmaceutical companies spent $102.3 billion on research and development (R&D) in 2021, of which 79.6 billion were spent domestically and 22.7 billion were spent globally.

Competitor Insights

Some of the key players operating in the large molecule drug substance CDMO market are AGC Biologics, Catalent, Inc., Rentschler Biopharma SE, Recipharm AB, Siegfried Holding AG, Boehringer Ingelheim, Eurofins Scientific, Samsung Biologics, WuXi Biologics, and FUJIFILM Diosynth Biotechnologies.

To achieve a competitive edge, these companies are implementing a variety of growth strategies. Strategic partnerships, alliances, and agreements with different businesses and research institutions are seen to be the main strategies used by companies in this sector.

- For instance, FUJIFILM Diosynth stated in September 2022 that its large-scale microbial manufacturing facility in Billingham, United Kingdom, would be expanding. The 1858 square metre (20,000 square foot) space will be expanded in order to meet the increasing demand for microbial development and manufacture.

This comprehensive research report focuses on the global and regional market size and forecasts of diverse segments including service, source, and end user from 2023 to 2033.

Report Scope:

| Key Parameters | Details |

|---|---|

| Market size in 2022 |

|

| CAGR |

|

| Base Year |

|

| Forecast Period |

|

| Study Coverage |

|

| Qualitative Analysis |

|

| Segment Market Scope |

|

| Regional Market Scope |

|

| Company Profiles |

|

| 15% Free Customization Available |

|

Segmentation: Large Molecule Drug Substance CDMO Market Report 2022 – 2033

Service (Revenue, USD Million), 2022 – 2033

- Contract Development

- Commercial

- Clinical

- Contract Manufacturing

- Process Development

- Cell Line Development

Source (Revenue, USD Million), 2022 – 2033

- Microbial

- Mammalian

- Others

End user (Revenue, USD Million), 2022 – 2033

- CRO

- Biotech Companies

- Others

By Region (Revenue, USD Million), 2022 – 2033

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East & Africa

- South Africa

- Saudi Arabia

- Rest of MEA

Table of Contents: Large Molecule Drug Substance CDMO Market 2022-2033

- Research Methodology

- Study Objectives

- Study Scope

- Research Framework

- Research Models

- Bottom-up Approach

- Top-down Approach

- Data Triangulation

- Data Analysis

- Data Validation

- Market Size Estimation

- Market Forecast Model

- Research Models

- Introduction: Large Molecule Drug Substance CDMO

- Executive Summary

- Market Dynamics

- Market Drivers

- Driver 1

- Driver 2

- Driver 3

- Driver 4

- Market Restraint

- Restraint 1

- Restraint 2

- Restraint 3

- Market Opportunities

- Opportunity 1

- Opportunity 2

- Opportunity 3

- Market Trends

- Trend 1

- Trend 2

- Trend 3

- Market Challenges

- Challenge 1

- Challenge 2

- Challenge 3

- Market Drivers

- Market Environment Analysis

- Porter’s 5 Forces Analysis

- PESTEL Analysis

- SWOT Analysis

- COVID-19 Impact Analysis: Large Molecule Drug Substance CDMO Market

- Market Analysis by Service

- Contract Development

- Contract DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Commercial

- CommercialMarket Forecast, 2022-2033 (USD Million)

- Clinical

- ClinicalMarket Forecast, 2022-2033 (USD Million)

- Contract Manufacturing

- Contract ManufacturingMarket Forecast, 2022-2033 (USD Million)

- Contract Development

- Contract DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Process Development

- Process DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Cell Line Development

- Cell Line DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Process Development

- Contract DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Commercial

- Contract DevelopmentMarket Forecast, 2022-2033 (USD Million)

- Contract Development

- Market Analysis by Source

- Microbial

- Microbial Market Forecast, 2022-2033(USD Million)

- Mammalian

- Mammalian Market Forecast, 2022-2033(USD Million)

- Others

- Others Market Forecast, 2022-2033(USD Million)

- Microbial

- Market Analysis by End User

- CRO

- CRO Market Forecast, 2022-2033(USD Million)

- Biotech Companies

- Biotech Companies Market Forecast, 2022-2033(USD Million)

- Others

- Others Market Forecast, 2022-2033(USD Million)

- CRO

- Regional Market Analysis

- Regional Market Trends Analysis

- North America Large Molecule Drug Substance CDMO Market

- North America Large Molecule Drug Substance CDMO Market

- North America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- S. Large Molecule Drug Substance CDMO Market

- S. Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Large Molecule Drug Substance CDMO Market

- Canada Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Canada Market Size and Forecast, 2022-2033(USD Million)

- S. Market Size and Forecast, 2022-2033(USD Million)

- North America Market Size and Forecast, 2022-2033(USD Million)

- North America Large Molecule Drug Substance CDMO Market

- Europe Large Molecule Drug Substance CDMO Market

- Europe Large Molecule Drug Substance CDMO Market

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Germany Large Molecule Drug Substance CDMO Market

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- UK Large Molecule Drug Substance CDMO Market

- UK Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- France Large Molecule Drug Substance CDMO Market

- France Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Spain Large Molecule Drug Substance CDMO Market

- Spain Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Italy Large Molecule Drug Substance CDMO Market

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Large Molecule Drug Substance CDMO Market

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Europe Market Size and Forecast, 2022-2033(USD Million)

- Italy Market Size and Forecast, 2022-2033(USD Million)

- Spain Market Size and Forecast, 2022-2033(USD Million)

- France Market Size and Forecast, 2022-2033(USD Million)

- UK Market Size and Forecast, 2022-2033(USD Million)

- Germany Market Size and Forecast, 2022-2033(USD Million)

- Europe Market Size and Forecast, 2022-2033(USD Million)

- Europe Large Molecule Drug Substance CDMO Market

- Asia Pacific Large Molecule Drug Substance CDMO Market

- Asia Pacific Large Molecule Drug Substance CDMO Market

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Japan Large Molecule Drug Substance CDMO Market

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- China Large Molecule Drug Substance CDMO Market

- China Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- India Large Molecule Drug Substance CDMO Market

- India Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Korea Large Molecule Drug Substance CDMO Market

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Australia Large Molecule Drug Substance CDMO Market

- Australia Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Large Molecule Drug Substance CDMO Market

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Australia Market Size and Forecast, 2022-2033(USD Million)

- South Korea Market Size and Forecast, 2022-2033(USD Million)

- India Market Size and Forecast, 2022-2033(USD Million)

- China Market Size and Forecast, 2022-2033(USD Million)

- Japan Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Market Size and Forecast, 2022-2033(USD Million)

- Asia Pacific Large Molecule Drug Substance CDMO Market

- Latin America Large Molecule Drug Substance CDMO Market

- Latin America Large Molecule Drug Substance CDMO Market

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Brazil Large Molecule Drug Substance CDMO Market

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Mexico Large Molecule Drug Substance CDMO Market

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Argentina Large Molecule Drug Substance CDMO Market

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Large Molecule Drug Substance CDMO Market

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of Latin America Market Size and Forecast, 2022-2033(USD Million)

- Argentina Market Size and Forecast, 2022-2033(USD Million)

- Mexico Market Size and Forecast, 2022-2033(USD Million)

- Brazil Market Size and Forecast, 2022-2033(USD Million)

- Latin America Market Size and Forecast, 2022-2033(USD Million)

- Latin America Large Molecule Drug Substance CDMO Market

- MEA Large Molecule Drug Substance CDMO Market

- MEA Large Molecule Drug Substance CDMO Market

- MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- GCC Large Molecule Drug Substance CDMO Market

- GCC Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- South Africa Large Molecule Drug Substance CDMO Market

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Large Molecule Drug Substance CDMO Market

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- Market Size and Forecast by Service, 2022-2033(USD Million)

- Market Size and Forecast by Source, 2022-2033(USD Million)

- Market Size and Forecast by End User, 2022-2033(USD Million)

- Rest of MEA Market Size and Forecast, 2022-2033(USD Million)

- South Africa Market Size and Forecast, 2022-2033(USD Million)

- GCC Market Size and Forecast, 2022-2033(USD Million)

- MEA Market Size and Forecast, 2022-2033(USD Million)

- MEA Large Molecule Drug Substance CDMO Market

- Competitor Analysis

- Market Share Analysis, 2022

- Major Recent Developments, 2019-2022

- Company Profiles

- AGC Biologics

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Catalent, Inc.

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Rentschler Biopharma SE

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Recipharm AB

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Siegfried Holding AG

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Boehringer Ingelheim

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Eurofins Scientific

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Samsung Biologics

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- WuXi Biologics

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- FUJIFILM Diosynth Biotechnologies

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 11

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 12

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 13

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 14

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- Company 15

- Company Snapshot

- Company Overview

- Financial Analysis

- Product Benchmarking

- Recent Developments

- AGC Biologics

- Conclusion

- Recommendations